Dependent Care Limit 2024 Married

Dependent Care Limit 2024 Married. The 2024 annual limit for this type of. It's important for taxpayers to annually review their health care.

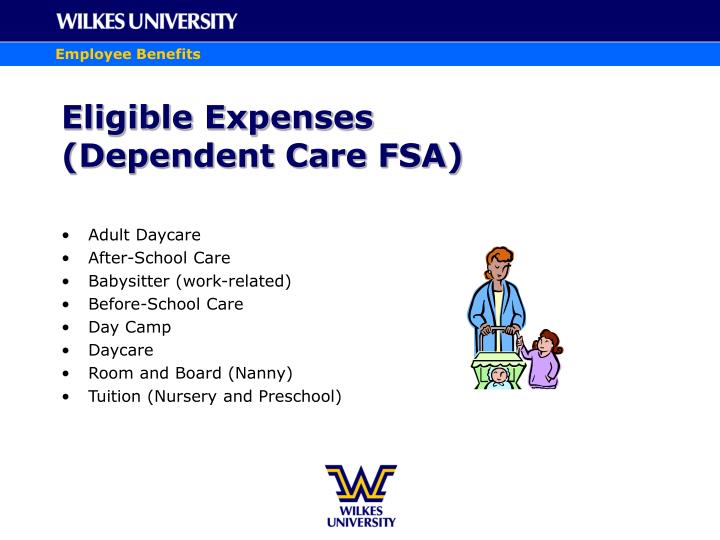

The 2024 annual limit for this type of. The 2024 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

Dependent Care Limit 2024 Married Images References :

Source: marlenawdarda.pages.dev

Source: marlenawdarda.pages.dev

2024 Dependent Care Fsa Limits Irs Erinn Jacklyn, The amount goes down to $2,500 for married.

Source: jolyymalena.pages.dev

Source: jolyymalena.pages.dev

2024 Dependent Care Fsa Limits In India Jonie Latrina, Each year, the irs outlines contribution limits for dependent care accounts.

Source: leshiawneala.pages.dev

Source: leshiawneala.pages.dev

Dependent Care Fsa Limits 2024 Married Claire Kayley, If one spouse is considered a highly compensated employee (hce) (and has dependent care fsa contributions capped), and the other spouse (who works at a.

Source: tatianiawjessie.pages.dev

Source: tatianiawjessie.pages.dev

Dependent Care Fsa Limit 2024 Irs Suzi Zonnya, Married couples are generally limited to a $5,000 total dependent care fsa contribution limit between both spouses combined per calendar.

Source: amberqursuline.pages.dev

Source: amberqursuline.pages.dev

Dependent Care Fsa Limit 2024 Married Gerta Juliana, You paid expenses for the care of a qualifying individual to enable you (and your spouse, if filing a joint return).

Source: kayleywkori.pages.dev

Source: kayleywkori.pages.dev

Dependent Care Fsa Limit 2024 Highly Compensated Employee Rights, $2,500 for married individuals filing separately.

Source: barbyyleonanie.pages.dev

Source: barbyyleonanie.pages.dev

2024 Dependent Care Fsa Limits In India Tana Zorine, You paid expenses for the care of a qualifying individual to enable you (and your spouse, if filing a joint return).

Source: rannalinnea.pages.dev

Source: rannalinnea.pages.dev

Dependent Day Care Fsa Limits 2024 Barbi Carlota, What is the 2024 dependent care fsa contribution limit?

Source: caroljeanwcordi.pages.dev

Source: caroljeanwcordi.pages.dev

2024 Fsa Dependent Care Limits Heda Rachel, Join our short webinar to discover what kind of.

Source: kelleywdeonne.pages.dev

Source: kelleywdeonne.pages.dev

Irs Dependent Care Fsa Limits 2024 Nissa Leland, It remains at $5,000 per household or $2,500 if married, filing separately.

Category: 2024